Are there ways around being ‘uninsurable’? The answer depends on how famous you are – and how likely you are to die in an incredible spectacle watched by the general masses of our planet.

Yes, the brave men who piloted the first NASA mission to the moon had to trust their engineers and ground crew that they were coming back. However their chance of survival certainly wasn’t a ‘sure thing’ – so they weren’t able to gain life insurance before the famous journey.

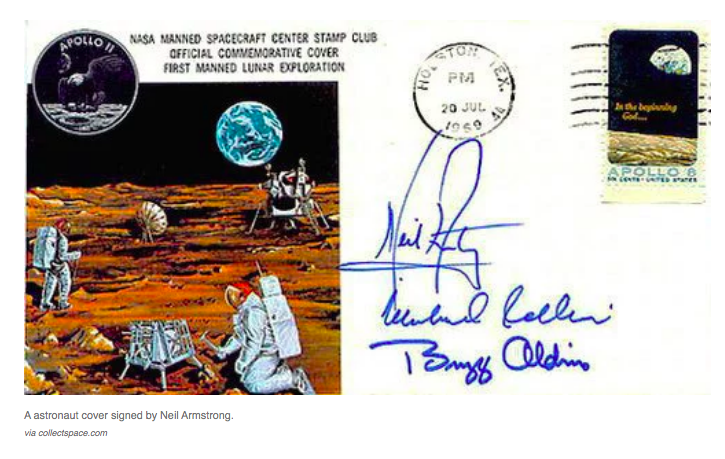

So when the Apollo 11 astronauts couldn’t get the cover necessary to help their families in the event of their deaths they came up with another solution: memorabilia.

It’s now well known that each astronaut stayed up on the nights before the launch signing hundreds of photos of themselves. They knew that these images would be of significant value should the worst happen. Thankfully for the families there was never any need to ‘make a claim’ with these photos.

Another ‘thinking outside the box (and the planet)’ approach from Apollo astronauts proved a little more controversial.

In 1972 it was discovered that the three astronauts of Apollo 15 had surreptitiously hidden over 400 postal covers into space and on to the surface of the Moon. They then sold these now very valuable stamps on to a West German stamp dealer in a hush-hush arrangement.

Unfortunately for the secretive spacemen, news quickly leaked of the deal. The three were punished by NASA, had to return the money and made to testify at a closed Senate hearing. None of them would fly in space again.

However by the end of the decade further investigations found that the government couldn’t keep the covers of stamps and in 1983, after a lawsuit, they were returned to the astronauts. In 2014 one cover of stamps sold for US$55,000.